Accounting Minor

The Accounting Minor is designed to provide students (both at Fisher and throughout the university) with an opportunity to expand their knowledge and build competency in accounting in order to complement their major/specialization area of study and better differentiate themselves in the job market.

The Accounting minor does not have an application process, though students are strongly encouraged to declare the minor early in their academic program. By alerting their academic advisor of their intent to complete the minor, students can ensure that the correct plan is assigned to their records and tracked in the degree auditing system. To graduate with an Accounting Minor, students who complete the following coursework need only verify with their academic advisor that the minor appears complete in the degree auditing system. No approval from Fisher College of Business is required.

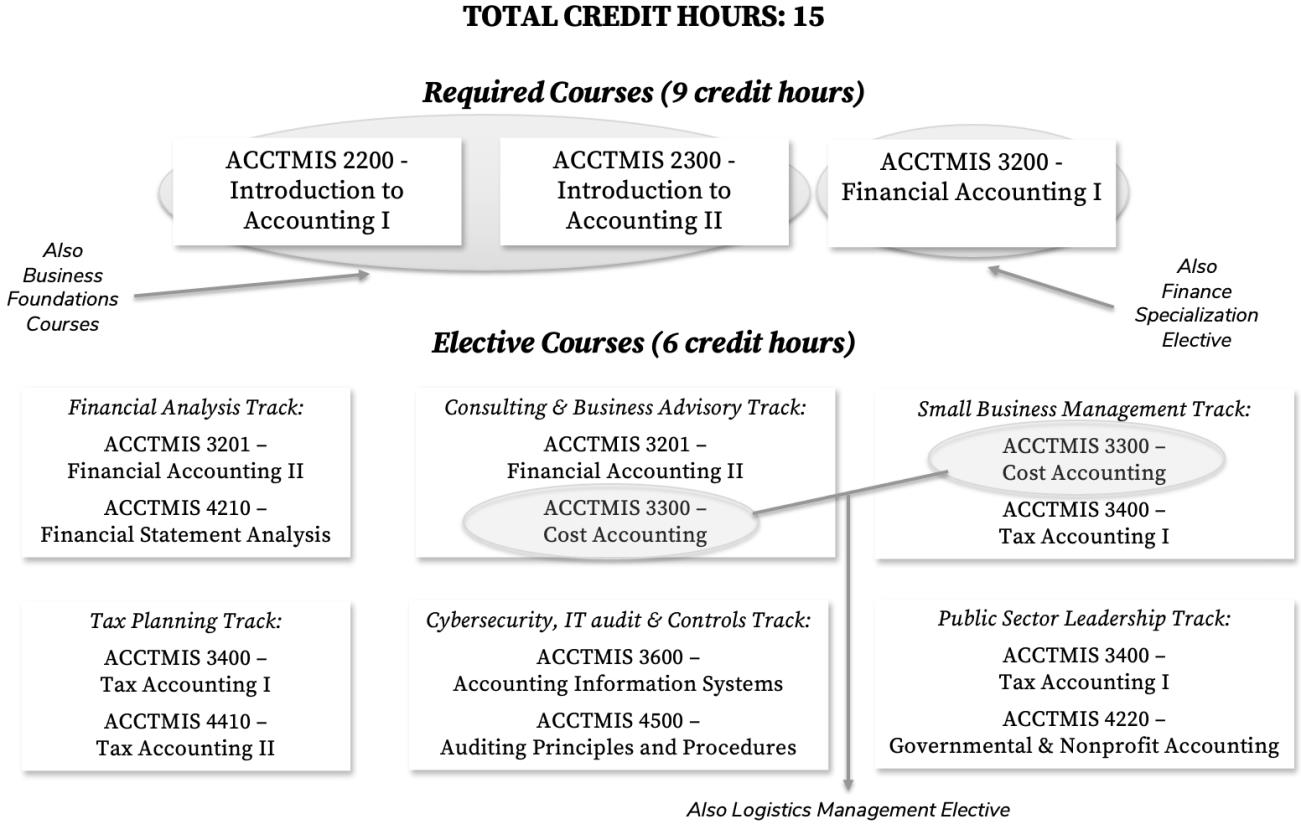

The minor requires the successful completion of a minimum of 15 hours, composed of three required course (9 credit hours) coupled with two elective courses (6 credit hours).

Required Courses (9 credit hours; 3 credit hours each)

Prerequisites: ECON 2001.01.

Description: Preparation and use of accounting reports for business entities; focus on uses of accounting for external reporting, emphasizing accounting as a provider of financial information.

Prerequisites: ACCTMIS 2200 and ECON 2001.01

Description: The uses of accounting reports by managers to make business decisions and to control business operations; focus is on the internal use of accounting information.

Prerequisites: ACCTMIS 2300

Description: Theory and application of accounting techniques to record and report financial information; asset and liability valuation; income measurement; first of two-course sequence.

Elective Courses (Choose 2 courses; 3 credit hours each)

Prerequisites: ACCTMIS 3200

Description: Theory and application of accounting techniques to record and report financial information; asset and liability valuation; income measurement; second of two-course sequence.

Prerequisites: ACCTMIS 2300

Description: Managerial decision making in organizations with an emphasis on the use of financial data; theory and practice of management control.

Prerequisites: ACCTMIS 3200

Description: Fundamentals of the federal income tax, and how it influences taxpayer decisions. Emphasis is on the individuals and businesses organized as proprietorships, but rules generally applicable to all taxpayers are covered.

Prerequisites: ACCCTMIS 3200

Description: The design of accounting information systems; focus is on business processes and internal control.

Prerequisites: ACCTMIS 3201

Description: Methods of fundamental analysis will be examined in detail; improve ability to use financial statements as part of an overall assessment of a firm's strategy and valuation.

Prerequisite: ACCTMIS 2200

Description: Focuses on financial reporting concepts and standards for non-profit and governmental units, evaluation of performance and the analysis and interpretation of financial statements of selected non-profit and governmental organizations.

Prerequisites: ACCTMIS 3400

Description: Intensive study of the federal income tax treatment of business corporations and partnerships, with particular attention to tax planning by these businesses and their owners.

Prerequisites: ACCTMIS 3200

Description: Basic concepts and standards of auditing; audit procedures and working papers, internal and external audit reports; professional responsibilities of auditors.

Overlap with Major and additional Minors

- The minor must be in a different subject than the major

- The minor must contain a minimum of 12 credits distinct from the major and/or additional minor(s)

- For Fisher BSBA (non-accounting) students, ACCTMIS 2200 & 2300, both of which are required "Business Foundation" courses and are not considered part of the major, are eligible to overlap with the Accounting minor; those courses count for 6 of the 12 distinct credits for the minor.

- ACCTMIS 3200 is an approved elective for the BSBA Finance specialization, so students specializing in Finance can count this course towards their Accounting minor as well and would therefore only need to take two elective accounting courses from the approved list to complete the requirements for the Accounting minor.

- ACCTMIS 3300 is an approved elective for the BSBA Logistics specialization, so students specializing in Logistics Management can count this course towards the Accounting minor as well and would therefore only need to take ACCTMIS 3200 and at least one additional accounting elective course from the approved to complete the requirements for the Accounting minor.

The following tracks (though not inclusive of all options available to students ) provide suggestive guidance as to elective offerings that align with student interest and goals.