For Nicolas Meader (BSBA ’23) there is no reward without risk

Some might say Nicolas Meader took a big risk when he decided to leave a six-figure job at age 22 to join the founding team of a new venture capital firm.

That risk, he said, made the decision even more appealing.

“Nothing is guaranteed,” he said. “I’d rather bet on myself than anyone else. The risk is what makes me excited to wake up and not dread going to work, like a lot of people my age.”

Meader, now 23, has bet on himself more than once ― completing his degree in three years, investing in three software companies before graduation and growing a personal portfolio worth millions.

Last spring, he became a founding principal with two other partners at Lioncrest Ventures. Their $100 million multi-strategy platform provides equity and private credit to early-stage technology companies.

The firm’s young investor is drawing a lot of attention in the world of venture capital. Industry insiders have called Meader (BSBA ’23) bold, savvy and a disruptor.

“A disruptor is someone or something that makes a big change in an existing industry,” he explained. “The ability to put a phone in your pocket was a huge disruptor to the telecommunications industry. In venture capital, being this young is fairly disruptive.”

Many in the industry don’t experience Meader’s level of success until at least their mid-30s.

“I think I was 20 years old when I made my first venture investment ― in a software company out of Silicon Valley,” he said.

His fascination with high-risk opportunities ultimately informed his career path.

“Venture capital offered that opportunity,” he said.

As a finance major and a member of the highly competitive Fisher Futures Investment Banking Program, Meader was on track for a career in the corporate sphere. He admired his Fisher Futures mentors who were well on their way to prestigious careers in the investment banking industry.

“They had the big job offers, and they had everything figured out,” said Meader. “They were showing that Ohio State can compete with the Ivy Leagues.”

But they also showed Meader what he didn’t want ― 80-hour work weeks in New York’s demanding banking and private equity industries.

“Venture capital has more of the West Coast vibe typically associated with tech and software start-ups out of The Bay,” he said.

That vibe appealed to him.

During his third year at Fisher he started attending pitch competitions, took an independent study course in venture capital and made that first investment.

“I think I was better at investing than I thought I was,” he said. “It’s a very risky industry, but if you’re good at your job you can potentially make 50 to 100 times on your money.”

He likes to tell the story of Jeff Bezos, who convinced his brother and sister to invest $10,000 each in Amazon when it was a fledgling online bookstore.

“That $10,000 today is worth $1.2 billion,” Meader said. “You can’t do that anywhere else, so that is what really intrigued me. The possibility of those wins, those companies that you invest in, and they take off like a rocket ship. It’s addictive after that. You’re chasing the next unicorn, the next billion-dollar company.”

Meader went to work as an investor for an Arizona-based venture capital firm after graduation, but he had a change of heart after a few months. He felt pulled to take another risk, this time on a larger scale.

“When the opportunity presented itself to build this fund from the ground up, I jumped on it in a heartbeat,” he said. “I was there before we had a single dollar in the bank or our LLC filed.”

Lioncrest Ventures launched in May with the intent to invest anywhere from $500,000 to $2 million in software technology companies across different industries, from health care to cybersecurity. Its capital comes from wealthy individuals, endowment funds and family offices.

“It sounds like a lot, but when you’re trying to increase a company’s worth to $1 billion, $1 million is a drop in the bucket. The goal is to get in as early as we can on a company we feel is going to blow up in the next couple of years,” he said.

Lioncrest plans to review up to 2,000 startups each year and only invest in four or five.

Meader is doing his part to engage others in the industry through his newsletter, Nick’s Notebook, that he recently launched on the media app Substack. It’s part industry trends and projections and part personal reflection. In the July issue, he wrote that he spends his mornings “hunched over diligence calls and data rooms as we narrow in on our potential first deal out of Lioncrest’s new fund.”

He explained that he pores over data for any signs of a red flag and spends hours on calls with company founders “picking apart” every detail he can find.

“The extent of the diligence we do on companies is pretty great,” he said. “This early, you’re taking a huge bet on someone. You’re giving them a lot of capital, and you’re trying to mitigate the likelihood that they could go to zero.”

Meader considers himself a good judge of character.

“If you’re a good person, you’re likable and you have a hell of a brain, that’s a good mix for success,” he said. “Ideally, in our founders, we would like to see all of those.”

Dan Oglevee, senior lecturer in finance, uses similar characteristics to describe Meader. He taught Meader in a venture capital class and later oversaw an independent study centered on the venture capital industry. Their conversations often extended well beyond class time, diving into real-world challenges, key players and emerging trends shaping the industry.

“I’m very proud of his accomplishments,” said Oglevee, who remembers his former student as a go-getter, a risk-taker and very smart.

“I saw him as a builder, and that is what he is doing now; he is building a new venture capital fund,” he said.

Meader doesn’t have a designated office. He works from airplanes, vacation destinations and his apartments on the East and West Coasts. He said he still puts in about 80 hours a week, but he has the flexibility and autonomy he always wanted.

It’s more fun than work for Meader.

“When people ask what I do, I tell them I’m in venture capital. If they ask what that is, I tell them I play Shark Tank in real life,” he said, referring to the popular reality television series where entrepreneurs pitch their products to a panel of famous investors called “sharks.”

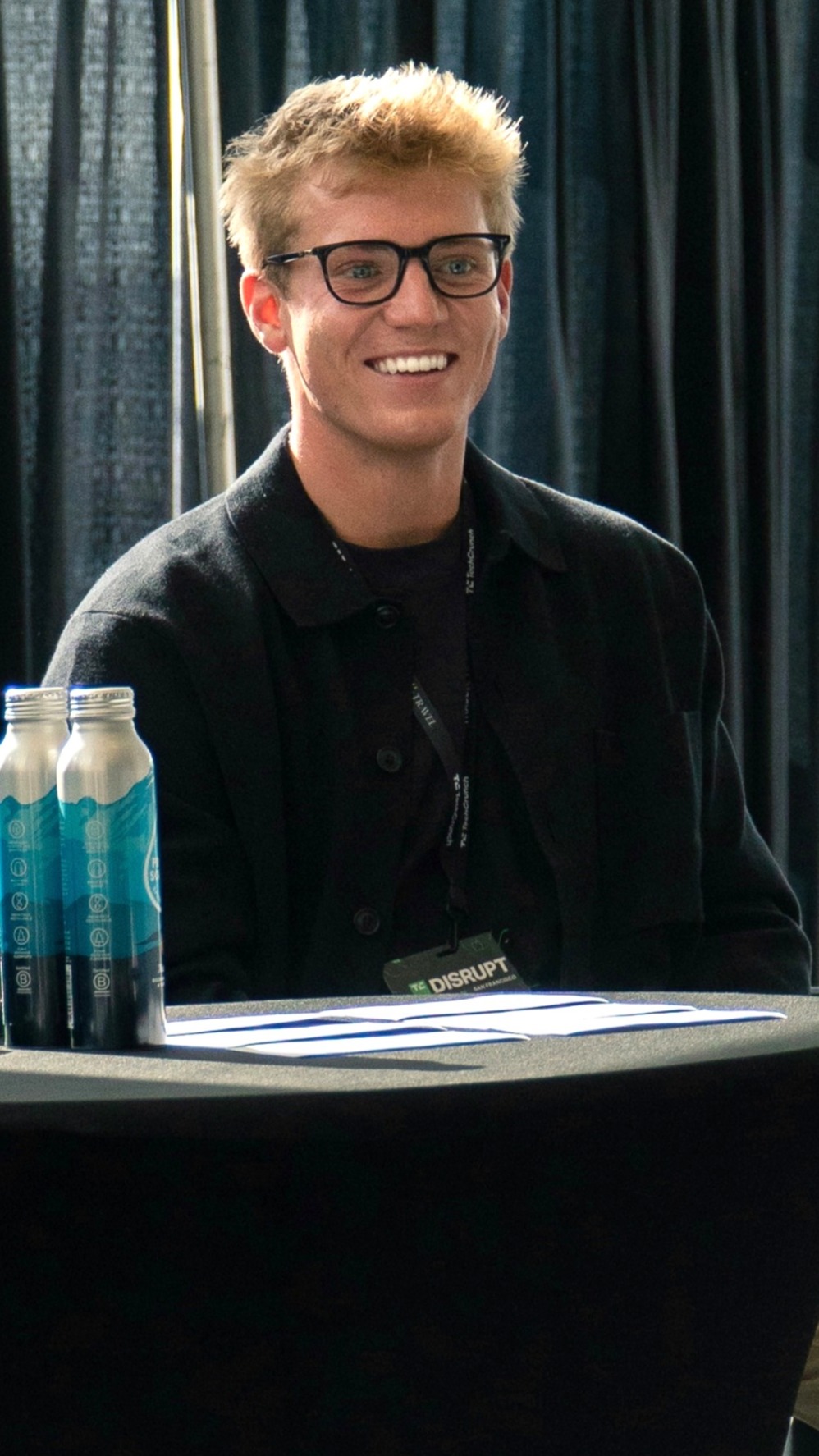

Last year, Meader spoke at the annual TechCrunch Disrupt, a premier technology conference for startups and investors. Though he describes himself as shy and introverted, Meader considered it a privilege to share the stage with some of tech’s biggest names and investors.

“I’ve never been a public speaker, but I think I’m starting to see how much value that can provide ― not only for myself, but for the people listening,” he said.

He also sees value in staying connected to his alma mater and drawing on talent from Ohio State. He is working now with the Integrated Business and Engineering (IBE) Honors program, a joint program between Fisher and the College of Engineering, to hire an intern whose technical knowledge and expertise will help inform their investment strategy.

“I can do the math, finance and statistics, but having someone familiar with the different software, tech stacks and integrations will be helpful,” he said. “As a young alumnus, I haven’t been in the real world that long. I remember what college was like, and I would have jumped at an opportunity like this. I’m trying to give back and make some hires from my alma mater.”

He also hopes to return for a football game or two and visit his younger brother, Tyler, who is entering his third year at Fisher ― and a potential recruit?

“I would love to hire him, but sometimes you don’t mix family and business, so we’ll see,” he said.

One thing is certain: Meader’s risk-taking continues to reap rewards.

“I think I wasn’t taken seriously for a long time; it didn’t matter how good my personal investments were, I was just a kid with some money making these investments,” he said. “Now, people are starting to know who I am. Hopefully, in a good way. That will bring more opportunities, more speaking engagements and founders.”

When people ask what I do, I tell them I’m in venture capital. If they ask what that is, I tell them I play Shark Tank in real life."